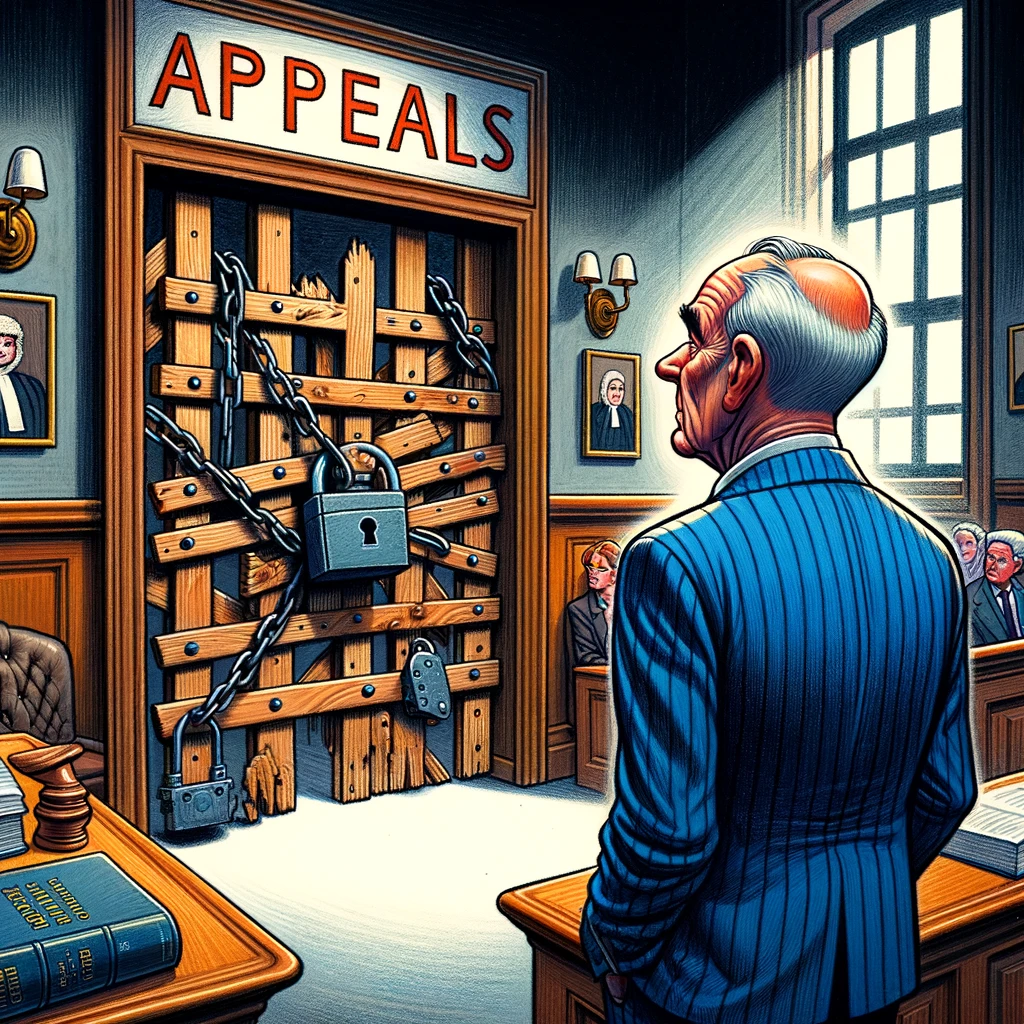

By now, you know about the $350 million-plus in damages that New York judge Arthur F Engoron awarded against Donald Trump and his companies. Trial-court news normally has a short expiration date, as it awaits the bigger news about what happens on appeal. But an appeal could be off the table because of a striking order at the end of the ruling. The order enjoins the Trump defendants from applying for any loans—and that might prevent them from getting an appeal bond. Here is the order:

“The Court hereby enjoins Donald Trump and the Trump Organization and its affiliates from applying for loans from any financial institution chartered by or registered with the New York Department of Financial Services for a period of three years.”

Like California, New York allows an appellant to stay enforcement of a money judgment upon posting a bond to secure payment of the judgment. (N.Y. CPLR 5519.) A bond is critical because, unless judgment-enforcement is stayed, an appeal is often impracticable. In addition to embarrassment, oppression, and harassment, the appellant’s attorneys have limited options to secure payment from a client whose assets are subject to seizure. For example, appellate attorneys cannot hold their client’s funds in trust because those funds may be subject to enforcement liens. (On multiple occasions, aggressive creditors’ counsel have imposed liens upon my appellate clients’ trust accounts, preventing me from securing payment for my appellate services.)

Bonding an appeal is a win-win: the appellant is able to pursue his appellate rights and pay his attorneys, and the prevailing parties are secured payment of their judgment. (See Venice Canals Resident Home Owners v. Superior Ct. (1977) 72 Cal.App.3d 675, 683 ["Requiring the posting of a stay bond serves the purpose of protecting the rights of innocent third parties.”].)

So Judge Engoron’s loan-prohibition is chilling. The trial judge’s ruling will have the effect of making it more difficult for the defendants to put up the collateral needed for an appellate bond. This hurts the defendants, obviously. Will it help creditors? To the contrary, if Trump is unable to post a bond, it may hurt creditors, who will not enjoy the benefit of having their judgment bonded.

What about protecting lenders? Will Judge Engoron protect lenders from extending bad loans? I do not know about New York lenders—perhaps they are not sophisticated enough to manage their transactions without the aid of a trial judge. But even so, Judge Engoron’s ruling is already extremely well-publicized, so any lender to be protected is already sufficiently on notice.

It is not clear what left is to be accomplished by the loan-prohibition—except to discourage an appeal. And discouraging appeals is not a legitimate use of judicial power. Perhaps the rule is different in New York, but in California a trial court cannot prohibit an appeal from its own judgment. (MacDonald v. Superior Court (1977) 75 Cal.App.3d 692, 696-697; see also In re Marriage of Reese & Guy (1999) 73 Cal.App.4th 1214, 1222, fn. 4 [finding it "highly inappropriate for a trial court to attempt to dissuade a litigant from exercising his or her right to appeal"].)

So under California law, an appellant would have a good argument that the order prohibiting the appellant from seeking a loan for purposes of securing an appellate bond likely would be unenforceable. But perhaps New York law is different.